October 29, 2024

By Scott Hinson, chief technology officer, Pecan Street

This series examines some of the biggest challenges facing the Texas grid and how they extend far beyond our state border. If you didn’t read the first installment, pause and take a few minutes to catch up.

Texas is home to four of the country’s ten largest cities, and suburban and exurban areas most people have never heard of are exploding. Eight of the country’s 15 fastest-growing cities are in Texas. Whether it’s tech, energy or just about any other industry, companies are moving to or starting in the Lone Star State, and the population boom shows no signs of slowing.

The boom has resulted in many benefits for many people, and satisfying increased electricity demand has always come with population growth. But it’s becoming increasingly urgent as more of the economy electrifies and our grid shows its age.

ERCOT Predicts Historic Growth

It’s also increasingly important as unique market regulations and cheap electricity continue to attract massive electricity users like crypto miners and data centers.

In its recent demand forecast, ERCOT predicted electricity demand could nearly double. Not in the next 50 years, but the next 5. And crypto and data center growth is an overwhelming culprit. Already, Texas is home to 10 of the world’s largest crypto-mining facilities, some of which can require 300 megawatts of electricity. Together, Texas’ crypto miners can “draw up to 2,600 megawatts” from the ERCOT grid – about the same amount required to power the entire Austin area.

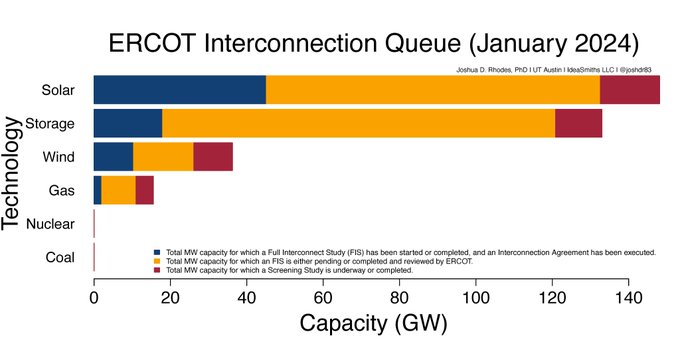

Why are we doing this to ourselves? I’ll remind you that taxpayers are on the hook to build new gas-fired power plants to meet the “pre-crypto” energy/reliability crunch. We can’t build enough gas power plants fast enough to meet ERCOT’s forecast, not to mention the fact we already have transmission bottlenecks that cause rates to skyrocket on high-demand days. It takes time to build transmission, even if you have good projections on load growth. With rapidly changing predictions, it’s hard to site transmission properly. Any strategic solution will have to include high levels of distributed renewable energy sources and demand-side management.

A New High-Risk Low-Reward Grid Stressor

There’s much to debate about the pros and cons of crypto mining in Texas. Time and Texas Tribune recently published exposés about the energy risk and debilitating health impacts on Texans who live near crypto facilities.

Then there’s the impact on energy costs and the environment. In addition to using huge amounts of electricity (the electricity required to generate one bitcoin would power an EV for 500,000 miles), many miners purchase electricity from power plants at rock-bottom prices before the electricity even enters the grid, then sell it back to utilities at a huge profit when the supply gets tight. Others get paid by ERCOT to not run their facilities when supply gets tight. And those new taxpayer-funded gas plants? A huge chunk of their power would be gobbled up by crypto and data centers. Researchers found that ”the voracious electricity consumption of artificial intelligence is driving an expansion of fossil fuel use — including delaying the retirement of some coal-fired plants.”

For all these questionable impacts, crypto facilities and data centers employ startlingly few Texans. For Texas, the cost-benefit, risk-reward of embracing the crypto and data industry skews dramatically toward cost and risk.

And alarmingly, there’s been scant public discussion or debate about any of this.

In fact, state leadership sounded surprised by ERCOT’s projection. The lieutenant governor posted: “We need to take a close look at those two industries. They produce very few jobs compared to the incredible demands they place on our grid… it can’t be the wild, wild west of data centers and crypto miners crashing our grid and turning the lights off.”

Yes! Exactly. More importantly, what are state leaders going to do about it? If history serves, the answer will probably be rooted in old-school fossil fuel thinking. That’s next time.