December 9, 2024

By Cavan Merski, data analyst, Pecan Street

Despite their emergence in the electricity generation and distribution landscape, the transformative potential of virtual power plants (VPPs) is poorly understood. Your average electricity customer – residential or commercial – has no idea what VPPs are. Even in the legislative and regulatory universe, VPPs are considered tomorrow’s technology and have not yet been fully integrated into grid planning efforts.

They should be.

Defining a New Energy Asset

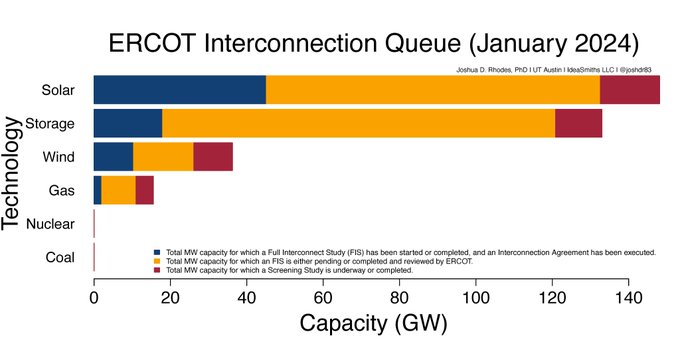

At their most basic level, VPPs are networks of distributed energy resources that are aggregated and remotely controlled and operated to balance the supply and demand on the grid. Assets include large-scale industrial resources like solar farms, battery facilities or industrial demand-response technology that can scale up or down very quickly. But they also include smaller, consumer-level resources. A network of hundreds of solar+storage homes can operate as a VPP, as can broad demand-response programs that shave demand by regulating air conditioner use on peak demand days in the summer.

Because these assets are closely managed in aggregate, they can be “dispatched” to increase supply or reduce demand nearly instantly – as fast as or even faster than a traditional power plant.

Moreover, because these assets are distributed by nature, they can be more effective in circumventing transmission limitations that traditional power plants face during peak demand periods. If a specific region that faces transmission limitations experiences a dramatic spike in demand, VPP assets in that region can balance local supply and demand. That not only helps increase reliability, it can reduce costs.

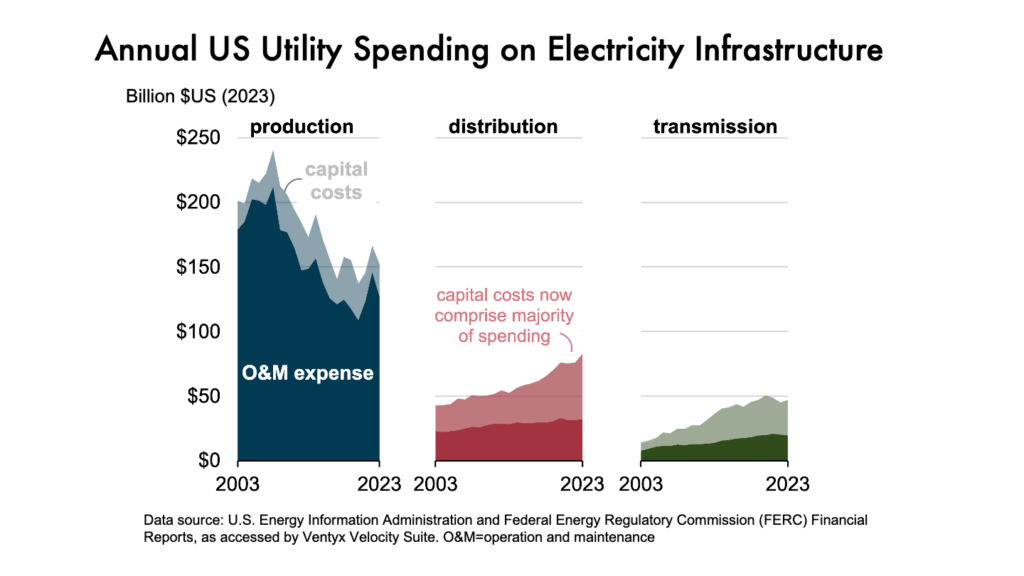

Transmission and distribution account for more than a third of the total cost of electricity (about 26% for distribution and about 12% for transmission). Moreover, the costs of transmission and distribution, the U.S. Energy Information Agency (EIA) says, are increasing, while the cost of generation (production) is declining. By localizing energy generation, VPPs can substantially lower these expenses, making electricity more affordable for consumers as grid demand increases.

Building Resilience

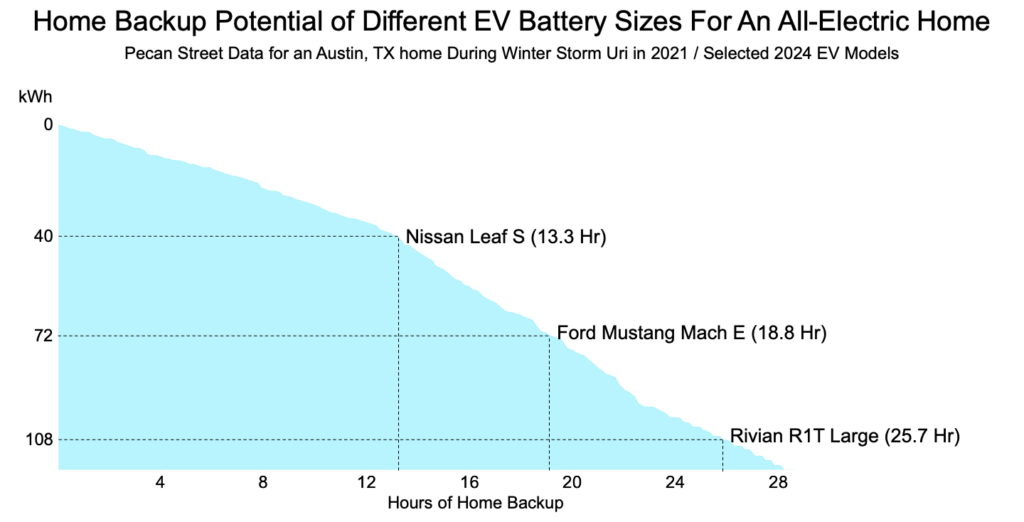

When storms or other natural disasters cause power outages, it’s usually the distribution network (the poles, wires and transformers we see all around our neighborhoods) that is disrupted. (Though the distribution network was indeed damaged during winter storm Uri in 2021, it was the infamous failure of electricity generation plants that nearly collapsed the grid.) If you have an electric vehicle that is fully charged at your home before a storm arrives, you could power loads in your home for several days with the appropriate wiring and hardware. Likewise, grid-scale batteries that are charged before a storm knocks out the distribution grid can power vital restoration functions during recovery efforts.

Building Abundance

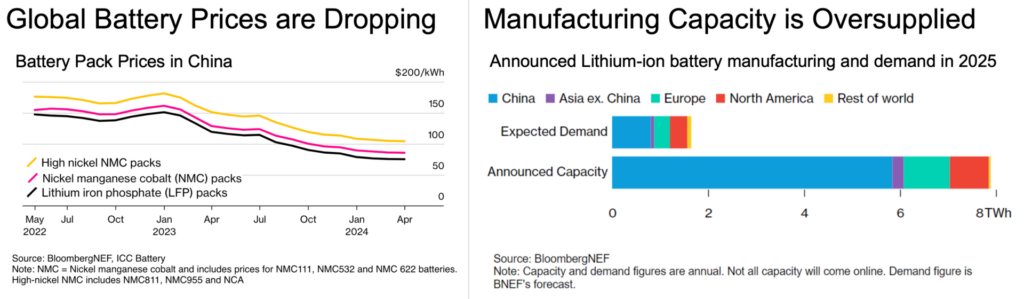

VPPs can facilitate the widespread adoption of renewable energy sources, tapping into the abundant solar, wind, and hydro resources available across different regions. Batteries of all sizes – from large grid batteries to moderately sized EV batteries to smaller home batteries – will unlock VPP capabilities in different ways. Grid-scale batteries will smooth out solar and wind generation to better match grid demands, while EV and home batteries can deploy during grid peaks to relieve congestion and reduce the need for expensive ‘peaker’ generation plants.

As battery costs continue to decline, EV penetration increases and more people install batteries in their homes, scaling their functionality via VPPs represents a transformative opportunity for the energy system. Consider just one example: In 2023, there were 200,000 registered EVs in Texas. Assuming an average battery capacity of 50 kWh (which is conservative; Ford’s extended-range Mustang is 91kWh), that’s one GWh of distributed energy storage that sits idle most of the day.

The potential of VPPs is significant, but there are some substantial obstacles standing in the way of broad implementation.

1. Regulatory Frameworks and Market Structures

For most electricity issues, policy drives adoption. It provides a predictable structure that instills confidence, reduces risk, and encourages innovation. For VPPs, this could include incentives for DER investments and establishing standards for interoperability. Traditional energy markets are often not designed to accommodate decentralized resources, so revising market structures to recognize and reward the contributions of VPPs can drive their adoption.

2. Technology Integration

VPP technology is somewhat of a chicken-and-egg situation.

Optimal VPP performance requires seamless integration of diverse energy resources within a VPP. That requires software platforms, communication technologies and a high enough penetration of home and EV battery systems to make VPPs a large enough opportunity to attract investment.

But it will take significant investment to fully develop those technologies and a compelling product to increase customer adoption. In addition, early innovators are likely to design systems that inhibit data compatibility and transportability. Here, again, policies that ready the market and require competitive standards can help drive innovation and adoption.

3. Consumer Engagement

Many “clean” or “modern” energy technologies have significant marketing weaknesses. When the Volt was introduced in the 2000s, Chevy marketed it as a climate solution. Only recently have EV companies embraced their speed, quickness, fuel savings and general “cool” factor.

VPPs offer significant customer benefits, but they’ve been poorly articulated. Regular people have no idea what a VPP is, how one would work, or why they should even care. You could say the same thing about the legislators and regulators whose decisions could spur or slow their development and adoption. In short, VPPs need a PR firm. It’s too early in the game for the concept to sell itself.

Just the Beginning

VPPs are today where EVs were more than a decade ago: a promising multi-benefit solution that few people know or care about. Our hope is that leaders will recognize their potential to strengthen the grid and implement policies that accelerate their development.